Bongdalu là một trang web thể thao uy tín, cung cấp đầy đủ thông tin về bóng đá dành cho người hâm mộ Việt Nam. Với sứ mệnh mang đến trải nghiệm tuyệt vời cho người dùng, chúng tôi không ngừng cập nhật tin tức mới nhất, phát triển tính năng đa dạng và tối ưu giao diện thân thiện.

Giới thiệu về Bongdalu

Được thành lập vào năm 2015 bởi một nhóm người hâm mộ và yêu thích bóng đá tại Việt Nam. Ban đầu Bongdalu này chỉ cung cấp thông tin về các giải đấu lớn như World Cup, Euro, Champions League. Tuy nhiên, với sự phát triển không ngừng của công nghệ và nhu cầu ngày càng cao của người hâm mộ, website đã không ngừng cập nhật và mở rộng nội dung để đáp ứng nhu cầu của đông đảo người hâm mộ thể thao.

Hiện nay, nơi đây đã trở thành một trang web thể thao uy tín hàng đầu Việt Nam. Chúng tôi tự hào mang đến cho người dùng trải nghiệm tuyệt vời với kho tàng thông tin khổng lồ, được cập nhật liên tục 24/7 về mọi khía cạnh của bóng đá.

Giới thiệu về Bongdalu

Tính năng nổi bật của Bongdalu

Nổi bật trong số các trang web thể thao hiện nay, Bongdalu thu hút người dùng bởi những tính năng vượt trội, đáp ứng được nhu cầu của người hâm mộ. Dưới đây là những điểm sáng tạo nên sự khác biệt:

Tin tức bóng đá

Bongdalu sở hữu đội ngũ biên tập viên chuyên nghiệp, dày dặn kinh nghiệm, luôn cập nhật tin tức mới nhất về bóng đá 24/7. Tại đây có đầy đủ các tin tức chuyển nhượng, chấn thương cầu thủ, cho đến những bài phân tích chuyên sâu về các trận đấu,… Tất cả đều đều được trình bày một cách đầy đủ và chính xác trên hệ thống.

Trực tiếp bóng đá

Người dùng tại Bongdalu sẽ được cung cấp hệ thống link xem trực tiếp các trận đấu bóng đá chất lượng cao, ổn định trên nhiều giải đấu khác nhau như World Cup, Euro, Champions League, Ngoại hạng Anh, La Liga,… Người hâm mộ có thể dễ dàng theo dõi các trận đấu yêu thích của mình mọi lúc mọi nơi.

Kết quả thi đấu/ Bảng xếp hạng

Nếu bạn đang tìm kiếm một trang website để theo dõi đầy đủ các kết quả thi đấu bóng đá của mọi giải đấu trên thế giới thì đừng bỏ qua Bongdalu. Tại đây người hâm mộ có thể dễ dàng tra cứu kết quả thi đấu của các trận đấu đã diễn ra và đưa ra dự đoán cho các trận đấu sắp tới.

Tính năng nổi bật của Bongdalu

Lịch thi đấu

Để không bỏ lỡ bất cứ trận đấu nào sắp diễn ra, bạn đừng quên theo dõi lịch thi đấu được cung cấp tại đây. Mọi giải đấu lớn nhỏ đều được chúng tôi theo dõi và đưa thông tin chính xác đến người hâm mộ.

Video clip

Dù không theo dõi trực tiếp các trận đấu, bạn vẫn có thể xem lại highlight hấp dẫn bất cứ lúc nào tại Bongdalu. Chúng tôi cung cấp kho video clip khổng lồ về bóng đá, bao gồm video clip bàn thắng, highlights, phỏng vấn, và nhiều nội dung hấp dẫn khác.

Bạn có thể xem lại những pha bóng đẹp mắt, những khoảnh khắc ấn tượng và những bài phỏng vấn độc quyền của các cầu thủ và huấn luyện viên.

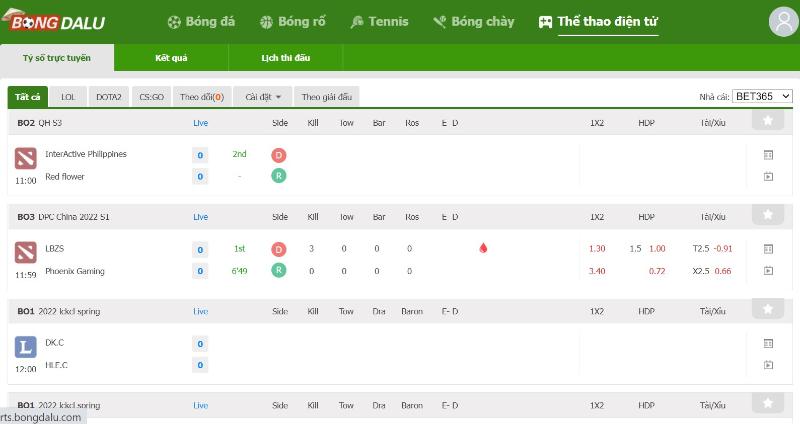

Tỷ lệ kèo

Một trong những thông tin mà các cược thủ vô cùng quan tâm đó chính là chuyên mục tỷ lệ kèo tại đây. Chúng tôi cung cấp tỷ lệ kèo của các trận đấu một cách nhanh chóng và chính xác. Bạn có thể dễ dàng so sánh tỷ lệ kèo của các nhà cái khác nhau và đưa ra lựa chọn đặt cược phù hợp.

Phân tích trận đấu chi tiết

Các giải đấu hấp dẫn được đưa tin tại Bongdalu

Bongdalu tự hào là cổng thông tin bóng đá hàng đầu Việt Nam, nơi bạn có thể cập nhật tin tức, theo dõi trực tiếp và tham gia bình luận về các trận cầu đỉnh cao trên toàn thế giới. Nơi đây quy tụ đầy đủ các giải đấu lớn nhỏ, từ quốc tế đến quốc gia, đáp ứng nhu cầu đa dạng của người hâm mộ.

Bên cạnh những giải bóng đá quốc tế danh giá như World Cup, Euro, Champions League, Europa League,… Chúng tôi còn cung cấp thông tin chi tiết về các giải bóng đá châu lục hấp dẫn như: Ngoại hạng Anh, La Liga, Bundesliga, Serie A, Ligue 1,…

Là một trang web hướng đến người hâm mộ Việt Nam, Bongdalu đặc biệt chú trọng vào các giải bóng đá quốc gia, bao gồm V-League, Cúp Quốc gia, Siêu cúp Quốc gia. Người hâm mộ có thể dễ dàng theo dõi lịch thi đấu, bảng xếp hạng, kết quả thi đấu và các tin tức nóng hổi liên quan đến các đội bóng và cầu thủ yêu thích.

Ngoài ra, chúng tôi còn cung cấp thông tin về các giải bóng đá trẻ, giải bóng đá nữ và các giải bóng đá phủi. Với kho tàng dữ liệu khổng lồ và cập nhật liên tục, nơi đây là điểm đến lý tưởng cho những người yêu thích bóng đá.

Hướng dẫn sử dụng Bongdalu

Với giao diện trực quan và dễ sử dụng, website của chúng tôi mang đến trải nghiệm mượt mà cho mọi người dùng. Dưới đây là hướng dẫn chi tiết cách sử dụng để bạn có thể truy cập và trải nghiệm các tính năng của trang web một cách nhanh chóng và hiệu quả nhất:

Bước 1: Truy cập trang web chính thức của Bongdalu bằng máy tính hoặc điện thoại di động, miễn là có internet.

Bước 2: Có hai cách chính để tìm kiếm thông tin trực tiếp trên webisite này:

- Thanh tìm kiếm: Nhập từ khóa liên quan đến thông tin bạn muốn tìm kiếm (ví dụ: tên đội bóng, tên cầu thủ, giải đấu, v.v.) vào thanh tìm kiếm và nhấn Enter.

- Menu website: Sử dụng menu website để truy cập các mục thông tin chính như Tin tức, Trực tiếp, Kết quả, Lịch thi đấu, Bảng xếp hạng,

Bước 3: Sau khi tìm kiếm được thông tin bạn muốn, bạn có thể nhấp vào tiêu đề hoặc hình ảnh để xem chi tiết.

Bước 4: Đăng ký trở thành thành viên Bongdalu (không bắt buộc)

Bạn có thể đăng ký tài khoản tại đây để sử dụng các tính năng nâng cao như: lưu các trận đấu yêu thích, tham gia bình luận,…

Hướng dẫn sử dụng Bongdalu

Tại sao nên lựa chọn Bongdalu?

Với vô số trang web thể thao xuất hiện trên thị trường hiện nay, việc lựa chọn một địa điểm uy tín để cập nhật thông tin và theo dõi các trận cầu đỉnh cao là điều khiến nhiều người hâm mộ băn khoăn. Vậy tại sao nên lựa chọn Bongdalu?

Kho tàng thông tin bóng đá vô tận

Bongdalu cung cấp đầy đủ và chính xác mọi tin tức bóng đá trong nước và quốc tế, từ những giải đấu lớn như World Cup, Euro, Champions League… Bạn có thể dễ dàng tìm kiếm thông tin về các đội bóng yêu thích, cầu thủ nổi tiếng, lịch thi đấu, kết quả thi đấu, bảng xếp hạng,… chỉ với vài thao tác đơn giản.

Cập nhật tỷ số tức thì, chính xác

Website của chúng tôi cập nhật tỷ số trực tiếp của tất cả các trận đấu đang diễn ra một cách nhanh chóng và chính xác nhất. Anh em có thể theo dõi tỷ số theo thời gian thực, nhận thông báo về các bàn thắng, thẻ phạt, thay người,…

Giao diện trực quan

Với việc tối ưu giao diện website, chúng tôi mong muốn tất cả mọi người đều có thể sử dụng dễ dàng. Các tính năng được sắp xếp hợp lý, giúp bạn thao tác nhanh chóng và tìm kiếm thông tin một cách thuận tiện.

Cộng đồng người hâm mộ bóng đá sôi nổi

Tham gia cộng đồng Bongdalu, bạn có thể giao lưu, chia sẻ đam mê bóng đá với hàng triệu người hâm mộ khác trên khắp cả nước. Mọi người có thể cùng nhau bình luận, dự đoán kết quả, tranh luận về các trận cầu đỉnh cao và tạo nên một cộng đồng bóng đá sôi nổi, nhiệt huyết.

App tiện lợi

Hiện tại Bongdalu có cả ứng dụng cho hệ điều hành iOS và Android. Với ứng dụng này, bạn có thể cập nhật tin tức, theo dõi trực tiếp bóng đá, tham gia cộng đồng mọi lúc mọi nơi một cách tiện lợi.

Ứng dụng Bongdalu

Lời kết

Với nội dung phong phú, đa dạng, cập nhật liên tục và chính xác, Bongdalu hứa hẹn sẽ mang đến cho bạn những trải nghiệm tuyệt vời nhất với môn thể thao vua. Truy cập Bongdalu ngay hôm nay để không bỏ lỡ bất kỳ thông tin nào về trái bóng tròn!